The tech companies of the year took the stage in the ever-changing tech world. Player stocks, often referred to as the Magnificent 7, dominate the market and shape a trend. As we head into 2024, industry experts are optimistic. Predict that the tech bull market will continue. They expect performance from tech stocks, with an estimated growth of around 25% year over year.

Starting About Apple Stock Prediction 2024

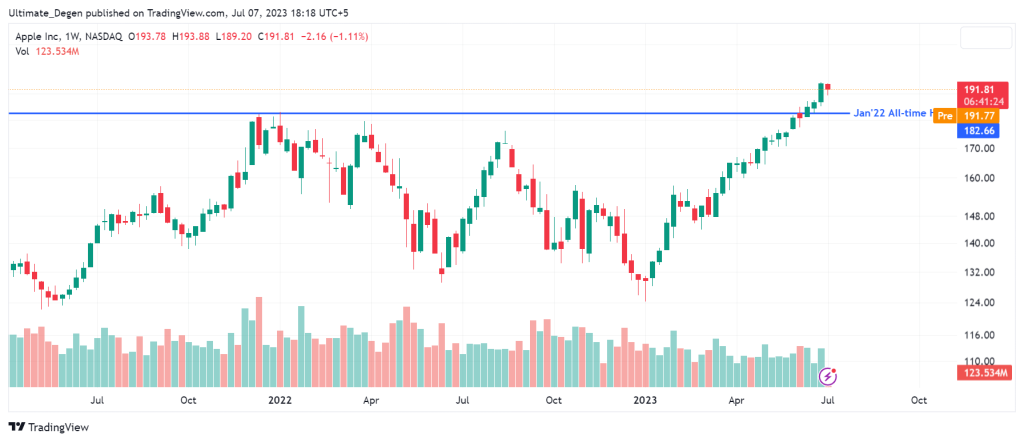

According to a respected analyst,Apple stock prediction the new wave of technological advancements with a presence in the financial industry is just beginning, paving the way for an impactful 2024. Looking back at the 48% growth seen in 2023, this analyst specifically highlighted Apple (AAPL). His success as a leading contender is expected to continue this year. Positive factors driving this outlook include Apple’s expected iPhone 15 upgrade cycle and the absence of any major disruptions in its supply chain, which was quite challenging in the previous year. Apple stock prediction The analyst believes Apple’s growing market in China and its ongoing competition with Huawei will contribute to performance throughout 2024. . But not all analysts share this sentiment. The Motley Fool Stock Advisor team, known for their outlook, recently released their “10 Best Stocks to Buy for Investors” list, surprising many by omitting Apple from their selection. Yield gains in the coming years. As an offer, the team is offering a 60% discount to new members who sign up for Apple stock prediction Advisor today.

Summary of Apple Stock 2024

StockAdvisor is well known for its role in offering a roadmap for navigating the complexities of the stock market to facilitate investment success. It provides portfolio updates from experienced analysts and guidance on creating two new stock recommendations every month. StockAdvisor has a track record of quadrupling the return of the S&P 500 since 2002.

In today’s technology-driven age, there is competition between tech giants that goes beyond Apple. Other industry leaders are also expected to play a role in shaping the 2024 narrative. Factors such as innovation, market dynamics, and global trends are essential for investors to consider their options. While some analysts project a year for Apple with a five-star rating, it’s important to consider market dynamics when making investment decisions. The technology sector is known for its dynamism. Caution and adaptability are required from investors. As tech giants continue to shape the future, it is crucial for investors to be alert to emerging opportunities as well as potential challenges.

In summary, it seems that 2024 will see growth driven by technological advancements, and according to analysts, Apple is ahead. Differing views within the community, however, emphasize the importance of having a well-rounded strategy guided by insights from multiple sources. As the technology story continues to evolve, it is important for investors to keep a diversified investment portfolio updated and carefully navigate the markets, paying attention to both opportunities and risks.

Year difference of Apple Stock

Since the beginning of the year, the demand from the famous technology giant Apple has been decreasing. The company’s performance in China has become a cause for concern due to increasing competition from Huawei. As a result, Apple shares fell 3% to a seven-week low after Barclays downgraded the firm’s stock. The downgrade is driven by concerns that demand for Apple devices may continue to decline throughout the year. Apple’s shares fell to 7.24 on the Nasdaq exchange, down 2.75% from opening at 7.15. Barclays now joins a brokerage in assigning the Cupertino-based technology giant a’sell’ rating equivalent to Apple’s stock.

A challenging part of Apple Stock 2024

Its performance in China is particularly noteworthy as demand slows, which Apple has been dealing with for years. Analyst Tim Long from Barclays expressed doubts about the iPhone 15’s performance. A fate prediction for the upcoming iPhone 16. It highlights the challenges Apple faces in a market where consumer choice and technological advancements shape success. Barclays’ concerns extend beyond Apple’s hardware division. . Apple currently has a market capitalization of $91 trillion. The recent drop in shares is expected to shave billions off the company’s market cap, which is significant considering Apple’s weight, as it represents 7% of the S&P 500. The challenges facing Apple highlight the changing nature of the technology industry, in which companies must navigate consumers. Trends, competition, and global economic conditions. Apple’s share decline serves as a reminder that even industry giants are not immune to market fluctuations and external pressures.